Calculate gross pay from w2

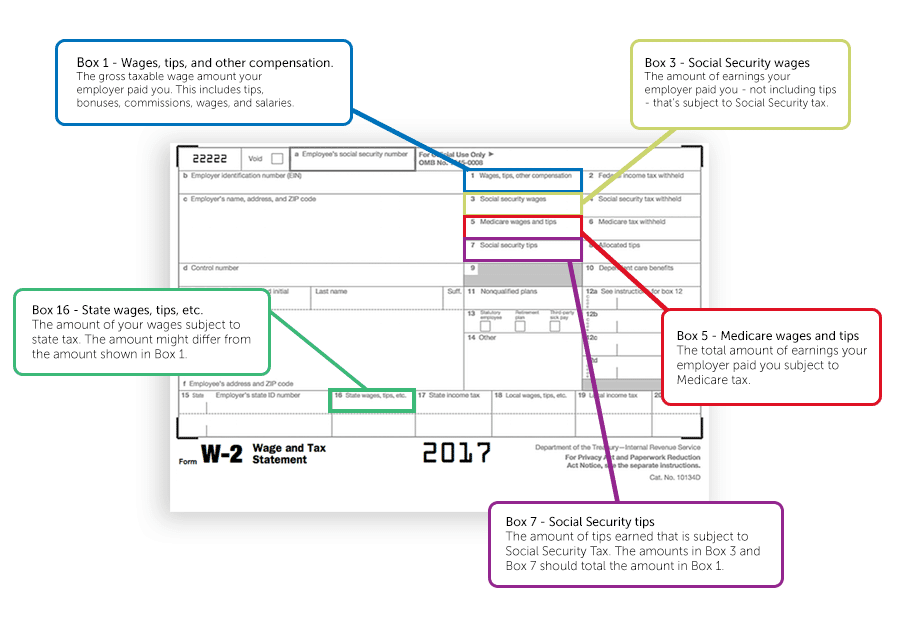

Suppose your gross pay is 500000 per year if your annual. Use your last pay stub for the year to calculate the taxable wages in boxes 1 and 16 in your W-2.

How To Calculate Agi From W 2 Tax Prep Checklist Income Tax Return Tax Deductions

Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan.

. Your pay stub and IRS Form W-2 include gross income data but for different reasons. Box 1 shows the amount of gross taxable wages an employer paidThese wages include tips bonuses commissions and salaries. Adjusted Gross Income and Taxes.

See how your refund take-home pay or tax due are affected by withholding amount. Ad 1 Use Our W-2 Calculator To Fill Out Form. Using the formula to calculate net pay.

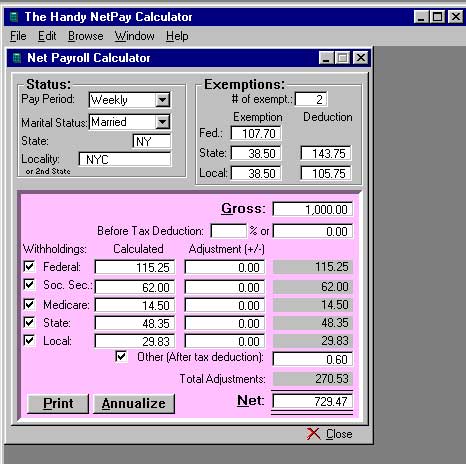

Your employer withholds a 62 Social Security tax and a. Federal state and local income taxes. When calculating your take-home pay the first thing to come out of your earnings are FICA taxes for Social Security and Medicare.

How Income Taxes Are Calculated. Then sum up all adjustments to income also known as above-the-line deductions that you made in the last year. How It Works.

Gross Income Gross Revenue Cost of Goods Sold. Then subtract the total taxes that will be withheld from your income from your the number you calculated in step three. 2 File Online Print - 100 Free.

If an employee worked 40 regular hours and 10 overtime hours in one week with a regular pay rate of 20 per hour the calculation would look as follows. Use this tool to. The gross income figure is adjusted for any deductions or exemptions which are formally known as above-the-line deductions.

In a few easy steps you can create your own paystubs and have them sent to your email. However you can calculate your adjusted gross income using your W2. Gross income refers to the total income earned by an individual on a paycheck before taxes and other deductions.

After all those steps above you may subtract the total taxes from your gross income from the number you got from your pretax deductions and your other. Plug in the amount of money youd like to take home each pay period and this calculator will tell you what your before-tax earnings need to be. To calculate net pay deduct FICA tax.

Ad Create professional looking paystubs. To calculate your adjusted gross. While your pay stub.

40 regular hours x 20. You cannot find the adjusted gross income directly on your W2 form. We use the most recent and accurate information.

Ordinarily your gross pay is all of your income before any deductions are taken out. Calculate your Total W-2 Earnings. 2 File Online Print - 100 Free.

Estimate your federal income tax withholding. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. And health insurance from the employees gross pay.

Lastly subtract the total above-the-line deductions from your. Begin with the Gross Pay YTD year-to-date and make the following adjustments if applicable. Ad 1 Use Our W-2 Calculator To Fill Out Form.

Wages Tips and Other Compensation.

4 Last Minute Tax Tips Tax Brackets Saving For Retirement Income Tax

How To Calculate W2 Wages From Paystub Paystub Direct

How To Calculate Your Net Salary Using Excel Salary Excel Ads

Adjusted Gross Income On W2 How To Calculate Walletgenius

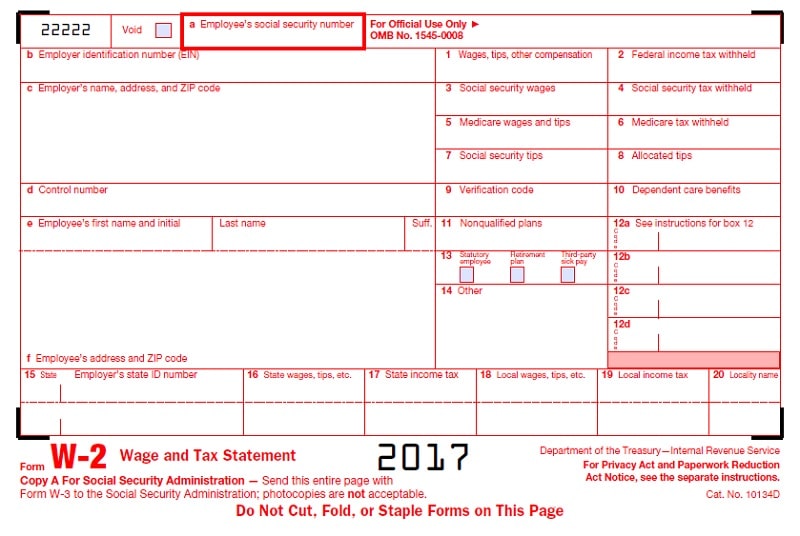

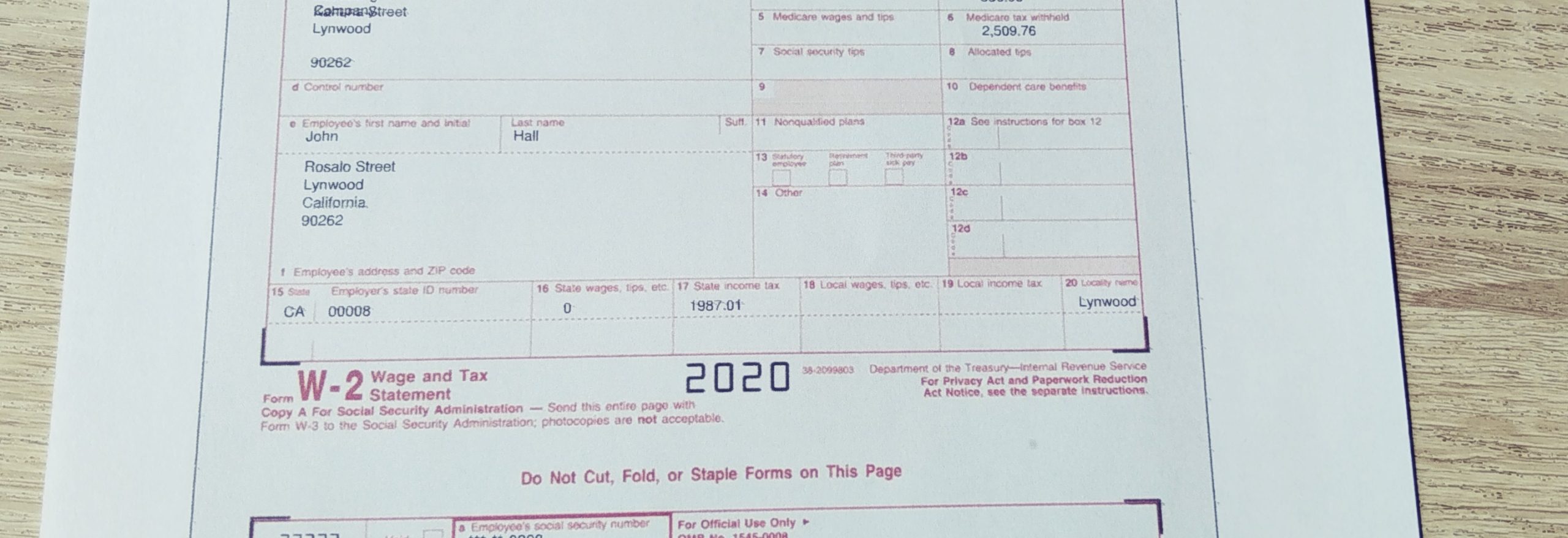

Irs W 2 Form Pdffiller W2 Forms Tax Forms Irs

How To Calculate Agi From W 2 Tax Prep Checklist Tax Prep Tax Refund

How To Calculate Agi Adjusted Gross Income Using W 2 Exceldatapro

What Is Adjusted Gross Income H R Block

W 2 1099 Filer Software Net Pr Calculator

So You Have Stock Compensation And Your Form W 2 Just Arrived Now What The Mystockoptions Blog

Solved W2 Box 1 Not Calculating Correctly

W 2 Vs Last Pay Stub What S The Difference Aps Payroll

How To Calculate Agi Adjusted Gross Income Using W 2 Exceldatapro

W 2 Wage And Tax Statement Data Source Guide Dynamics Gp Microsoft Docs

Adjusted Gross Income How To Find It On Your W2 Form Marca

How To Calculate W2 Wages From Paystub Paystub Direct

Form W 2 Explained William Mary